Tying it all together: Deposition roadmaps for Foreign Language review

Authors: Glenn Yamada and Remu Ogaki

Preparing for a deposition can be hard enough in English. Covering a broad range of potential lines of questioning by opposing counsel, as well as crafting one’s strategic narratives through lines of questioning in preparation for eventual trial can be exhausting.

The challenges increase exponentially when dealing with a deposition where the evidence is in a foreign language like Japanese. Mass translation of documents is cost prohibitive while reliance on machine translations presents litigation risks from a variety of factors including lack of cultural knowledge, legally significant alternative interpretations of the text, and mistranslations.

It is during times such as these that the quality of the foreign language eDiscovery team at your disposal makes the greatest difference.

The central problem lies in the fact that litigators are unable to read the documents themselves throughout the discovery process. Because they are forced to rely on specialist teams of eDiscovery reviewers to identify the key documents that can be used for deposition preparation, trying to piece together a coherent picture can be like sifting through a box of evidence while being forced to use a telescope.

That is where a Hilgers Graben Deposition Roadmap can be helpful.

A Deposition Roadmap is a detailed evidentiary guide that preserves the knowledge that the foreign language document review team has accumulated during the course of the discovery process. The people who have the greatest in-depth knowledge of the documentary evidence are the foreign language experts who have been reading and sorting the evidence every day.

A Deposition Roadmap takes that knowledge and uses it to condense and highlight interrelationships between key documents to make deposition preparation easier and faster.

Every important document is sorted into subject-specific chronology. All the key documents are sorted into buckets of subject matters, then the documents are sorted within those subjects by date. The chronology’s key document citations are linked to the database so a person can access the original document or its translation with the click of a button.

Rather than simply providing a summary of each document, entries helpfully link together documents that relate together in the chronology, even if they are separated in time, for maximum legibility and comprehensibility.

The Roadmaps go well beyond a simple Relativity export of metadata and attorney notes, to allow attorneys preparing for the deposition to benefit maximally from their foreign language experts.

The best way to understand the difference is to see an example.

The sample below is an excerpt from a real Deposition Roadmap, but with modifications to preserve client confidentiality. A document with a yellow date indicates a document in the chronology to which the deponent is likely aware of the contents, but may not have direct knowledge. A document with a green date indicated a document upon which the deponent was involved and had direct knowledge.

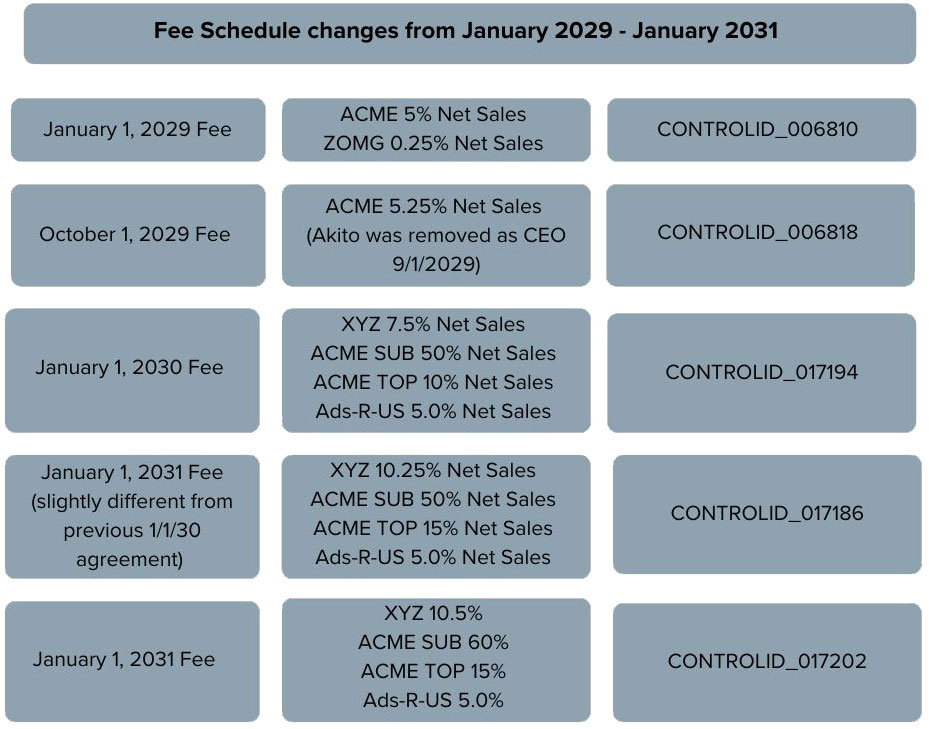

In this deposition, Hiroshi and Akito are in a dispute over whether a reasonable “fee” had been charged to a company after Akito was removed as CEO, and the accounting firm that conducted an audit in 2029 is being deposed as to whether the audit was conducted accurately. A particularly important document in the chronology might look like the entry on 10/25/2029 below.

***SAMPLE***

- 10/25/2029: Email discussion between Akito and Hiroshi regarding the Fee after Akito’s removal as CEO. Akito notes he has not spoken to Samuel yet but believes “any Fees should be pro rata based on ownership”. Hiroshi responds, “I appreciate your feedback but I am totally in disagreement with your suggestion of 70/30 and you know it would be crazy to add another 1.3%.”(ZOMG0014813) Hiroshi, in effect, suggests that a total 6.3% Net Sales fee would be “crazy.”

This discussion between Akito and Hiroshi put into context the dramatic rise in fee schedules based on ACME fees charged after Akito was removed as CEO on or around Sept. 2029. By January 2030, 80.5% of net sales were being collected as fees. See table below.

It may be unlikely that Accounting Firm ABC is directly aware of Akito and Hiroshi’s conversation on 10/25/2029, but Accounting Firm ABC is likely to be aware of the high Fees that were charged to Widgets Japan.

- 11/16/2029: Accounting Firm ABC Audit of 2029 XYZ LLC financial statement. Included detailed cash flow, revenue, and cost information. Data is likely useful for expert analysis of the ABC Audit 2030. (ZOMG002151)

- 11/19/2029: Accounting Firm ABC emails Hiroshi to confirm whether the money deposited to ACME account on 11/8/2029 should be categorized as part of the “Fee.” Hiroshi states he will call to discuss, (ZOMG002991)

About the Authors

Glenn Yamada, Counsel; Foreign Language Review Services

Glenn Yamada is a seasoned e-discovery attorney at Hilgers Graben, where he brings over a decade of expertise working in high-stakes, complex litigations. Follow him on LinkedIn here.

Remu Ogaki,

Counsel; Foreign Language Review Services

Remu has well over a decade of experience managing large teams of foreign language attorneys, paralegals and translators in the US and Japan. Follow him on LinkedIn here.